How Crypto is Powering Every day Payments in Africa

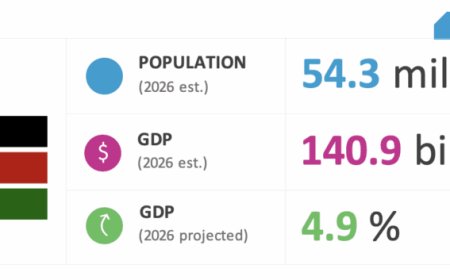

In 2026, Africa's Crypto narrative is shifting from speculation to utility. Discover how stable coins and block chain payments are solving real-world problems in cross-border trade, digital services, and e-commerce across the continent.

For years, the story of cryptocurrency in Africa was one of speculative investment—a high-risk bet on the future price of Bitcoin. In 2026, a quieter, more transformative narrative is taking hold. Across the continent’s vibrant consumer economy, crypto is no longer just an asset class; it is becoming a practical piece of financial infrastructure, enabling everyday payments for services, trade, and entertainment.

This shift from investment vehicle to utility tool is redefining participation in the digital economy, offering solutions where traditional finance has often created barriers.

Beyond the Price Charts: The Rise of Crypto as Utility

The initial African crypto boom was a response to local challenges: volatile national currencies, restrictive capital controls, and limited access to global finance. While storing value remains important, the focus is expanding to moving value. The key catalyst has been the adoption of stablecoins—digital currencies pegged to stable assets like the US dollar. By removing the fear of sudden price swings, stablecoins have made crypto a viable medium for daily transactions.

Wallets are being redesigned to look and feel like familiar payment apps, and a behavioural shift is underway. A generation already adept at switching between mobile money and banking apps now seamlessly incorporates crypto wallets into their financial toolkit. The digital rails are converging.

Where Crypto Payments Are Gaining Ground

The integration is most visible in specific sectors:

· Digital Services & Entertainment: Subscription platforms, content creators, and online gaming ecosystems are adopting crypto checkouts to reach users without international credit cards. This includes various online entertainment platforms, where crypto enables access without relying on traditional banking, broadening participation.

· Freelance & E-Commerce: African freelancers serving global clients use crypto to receive fast, low-fee payments. Small online sellers also leverage it to tap into the diaspora market, bypassing complex and expensive local payment gateways.

· Cross-Border Commerce: Crypto’s most profound impact may be in regional trade. Africa’s fragmented financial systems make transactions between countries slow and costly. Crypto payments, paired with local cash on-ramps and off-ramps, provide a smoother alternative that mirrors the continent’s dynamic informal cross-border trade.

Navigating Hurdles: Regulation & Infrastructure

Growth is not without friction. Regulatory landscapes remain a patchwork, with governments ranging from cautiously progressive to outright hostile. This uncertainty can stifle business integration. However, a trend is emerging: regulators are starting to differentiate between speculative trading and payment use cases, with some developing licensing frameworks to formalise service providers.

Infrastructure gaps also pose a challenge. Broader adoption depends on more reliable internet, better digital security education, and stronger consumer protections. Without these, there's a risk that crypto payments remain the domain of urban, tech-savvy populations, limiting their inclusive potential.

The Strategic Outlook for Businesses

For African businesses, crypto payments represent a strategic option, not a mandatory shift. Integration offers access to new customer segments—the unbanked, the diaspora, and international buyers. The savvy approach is one of flexibility: adding crypto as one payment rail among many, much like businesses once integrated mobile money alongside cash.

The future of payments in Africa is pluralistic. Crypto is not poised to replace mobile money or banking apps but to complement them, carving out a niche where its strengths—speed, borderless design, and lower costs—are decisive. In this quiet integration into the daily flow of commerce, crypto may finally deliver on a promise far more substantial than speculation: that of tangible, inclusive economic utility.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0