Treasury Eyes Tax Relief: Potential VAT and Income Tax cuts in 2026 Finance Bill

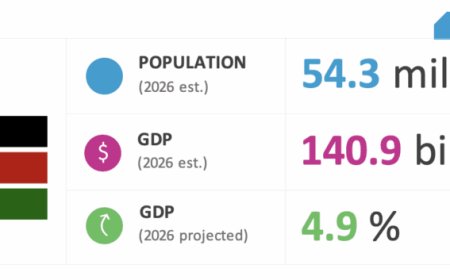

The Government of Kenya is considering cuts to VAT and Income Tax in the 2026 Finance Bill to ease burden on Tax payers. Learn about the potential savings and the economic balancing act behind the proposals.

In a move aimed at easing the financial burden on Kenyans, the National Treasury is considering significant tax relief measures, including potential reductions to both Value Added Tax (VAT) and Income Tax rates in the upcoming Finance Bill 2026. The proposals, revealed by Treasury Principal Secretary Chris Kiptoo, signal a government effort to boost household disposable income and stimulate economic activity.

Treasury Principal Secretary Chris Kiptoo made the announcement during a legislative retreat in Naivasha, outlining that the government is guided by its Medium Term Revenue Strategy. He stated that a reduction of VAT from the current 16% to 15% is under active consideration. Alongside this, the Treasury is evaluating adjustments to personal income tax rates, with any final decisions heavily dependent on the country's available fiscal space to ensure essential services are not compromised.

"The challenge is when you adjust downwards, and you do not get a corresponding expansion, then a challenge arises," Kiptoo cautioned, highlighting the delicate balance between providing taxpayer relief and maintaining sufficient government revenue for national development and stability.

If implemented, the combined effect of these tax cuts could provide tangible monthly savings for Kenyan families. For example, an individual earning Ksh 100,000 per month could see their income tax reduced by approximately Ksh 3,000. Simultaneously, a 1% VAT drop would lower the cost of everyday goods; a product priced at Ksh 1,000 before tax would decrease from Ksh 1,160 to Ksh 1,150. For a household spending Ksh 50,000 monthly on VATable items, this translates to a saving of Ksh 500. In total, an average household could gain an additional Ksh 3,500 per month, funds that could be redirected towards consumption, savings, or investment.

This government initiative comes amid sustained pressure from the public and private sectors for a more favorable tax regime. The calls for reform have been growing louder, with former Deputy Chief of Staff Eliud Owalo recently promising more aggressive cuts, including slashing income tax to 20% and VAT to 10%. Furthermore, in December, the Kenya Bankers Association proposed a major overhaul of the Pay-As-You-Earn (PAYE) structure, recommending raising the tax-free threshold from Ksh 24,000 to Ksh 30,000 and capping the top tax rate at 30%.

The Treasury is now finalizing its proposals for inclusion in the 2026 Finance Bill. The draft bill is expected to be presented to the Cabinet in the coming week, before being submitted to Parliament for debate and approval during the upcoming budget session. The final measures will be shaped by ongoing economic assessments as the government navigates the path between providing immediate relief and ensuring long-term fiscal sustainability.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0