U.S Embraces Partnership model in Africa with New Investment -Focused Strategy

The United States unveils a new Investment - led strategy in Africa, partnering with the African Union on Infrastructure to counter global rivals and build influence through shared economic growth, not aid.

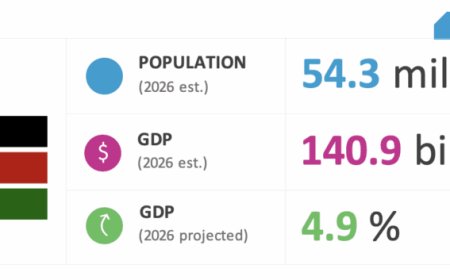

Facing intensified global competition, the United States is redefining its relationship with Africa by prioritizing mutual investment and strategic infrastructure projects over traditional aid models. In a significant shift, the United States is recalibrating its engagement in Africa, placing private capital, infrastructure finance, and trade integration at the forefront of its strategy. This move, crystallized in a new partnership with the African Union, reflects a global race for economic and geopolitical influence on the continent. The initiative aims to counter debt-heavy financing models from rivals by offering commercially-driven, long-term partnerships aligned with Africa’s own development ambitions.

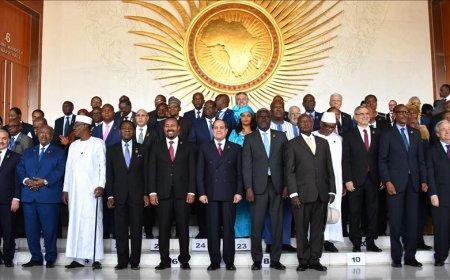

The centerpiece of this new approach is the Strategic Infrastructure and Investment Working Group, established jointly by the U.S. and the African Union Commission. Announced during high-level talks in Addis Ababa, the framework is designed to be a coordination platform linking senior officials and technical experts to identify bankable projects and mobilize U.S. private sector participation. The strategy moves decisively beyond traditional aid. Washington now frames Africa as a strategic economic partner with expanding markets and critical resources. The focus is on creating "durable, profitable investments" that foster shared prosperity rather than aid dependency.

Critically, the U.S. strategy is explicitly designed to support Africa’s own continental blueprints, marking a shift toward partnership. It aligns with key pillars like Agenda 2063, the African Union’s long-term development strategy, and the Programme for Infrastructure Development in Africa (PIDA). A central goal is to bolster the African Continental Free Trade Area (AfCFTA) by targeting transport corridors, energy systems, digital infrastructure, and regulatory harmonization—sectors essential to reducing trade costs and improving connectivity across the continent.

This recalibration occurs against a backdrop of intensifying global competition for influence in Africa. The U.S. move is a direct response to the expanding footprint of other global powers, primarily China and Russia, who have deepened ties through large-scale infrastructure financing and security partnerships. By offering an alternative model focused on private investment, transparency, and long-term commercial viability, the U.S. aims to provide African nations with more options. The strategy recognizes that Africa's vast infrastructure gap is both a developmental challenge and a strategic arena where future geopolitical influence will be decided.

The success of this investment-first strategy hinges on its execution. For African states, the framework offers a potential pathway to mobilize private capital for continental integration while avoiding unsustainable debt. For the U.S., it represents a strategic return to the continent, betting that shared economic success and integrated markets will define a new, more resilient chapter in U.S.-Africa relations. Ultimately, this shift signals a broader realization: in 21st-century geopolitics, sustainable influence is built not through aid, but through aligned economic interests and mutually beneficial partnerships.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0